2022-2023 Macro take

Disclaimer : NOT FINANCIAL ADVICE.

MACRO

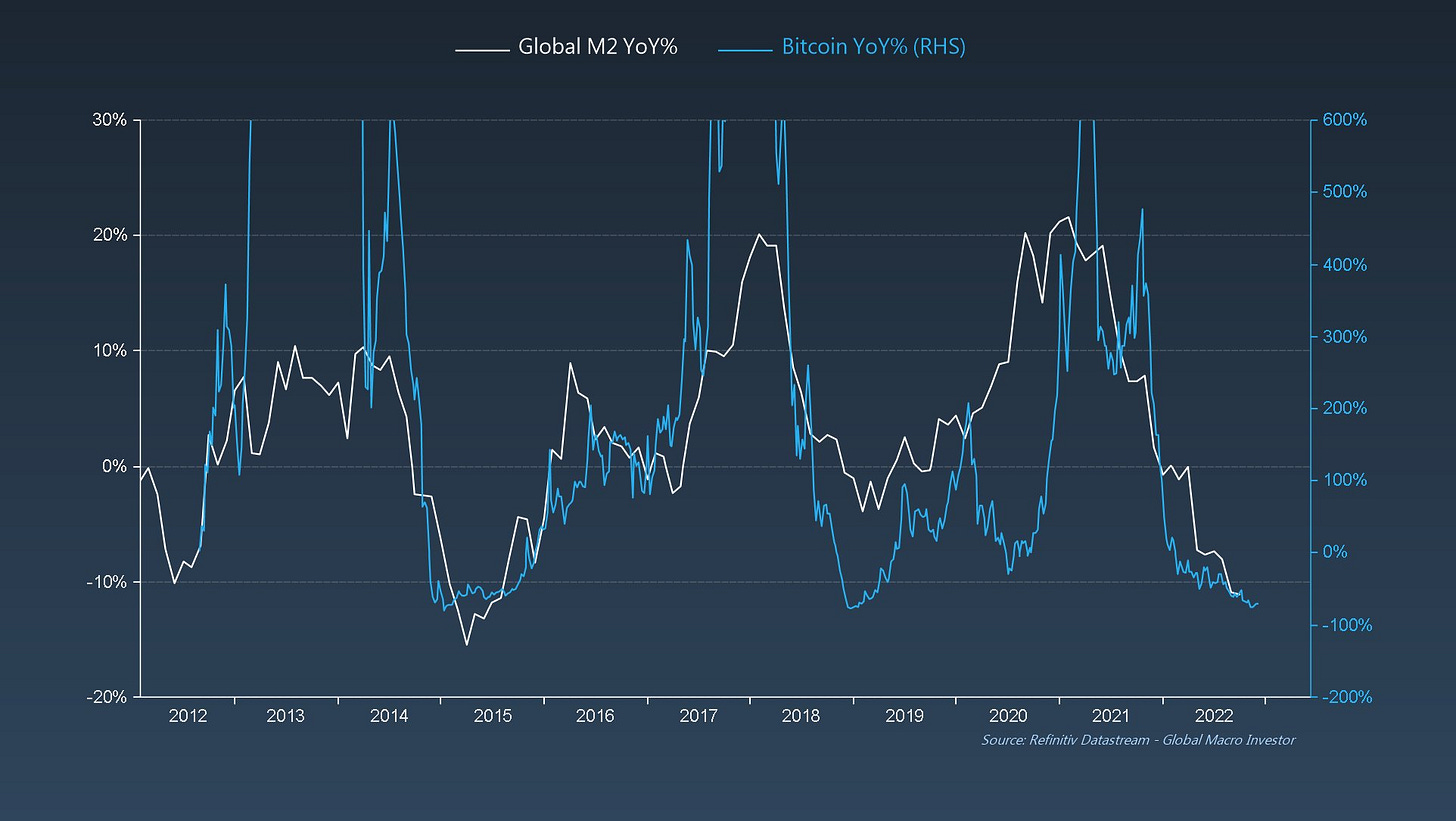

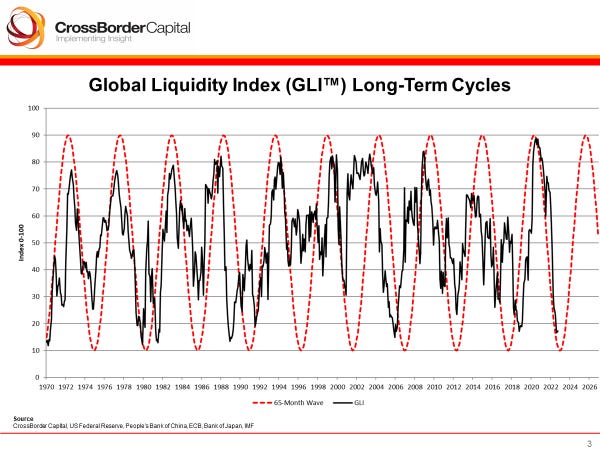

2022 have been a bloodbath to risk asset as the macro tides turned from post covid extreme loose monetary and fiscal stimulus environment into a tight one catching complacent market participants off guard, while markets are forced to repriced spike in interest rates (increased cost of money). Bitcoin which is sensitive to global liquidity fluctuation, have suffered 75% decline since all time high.

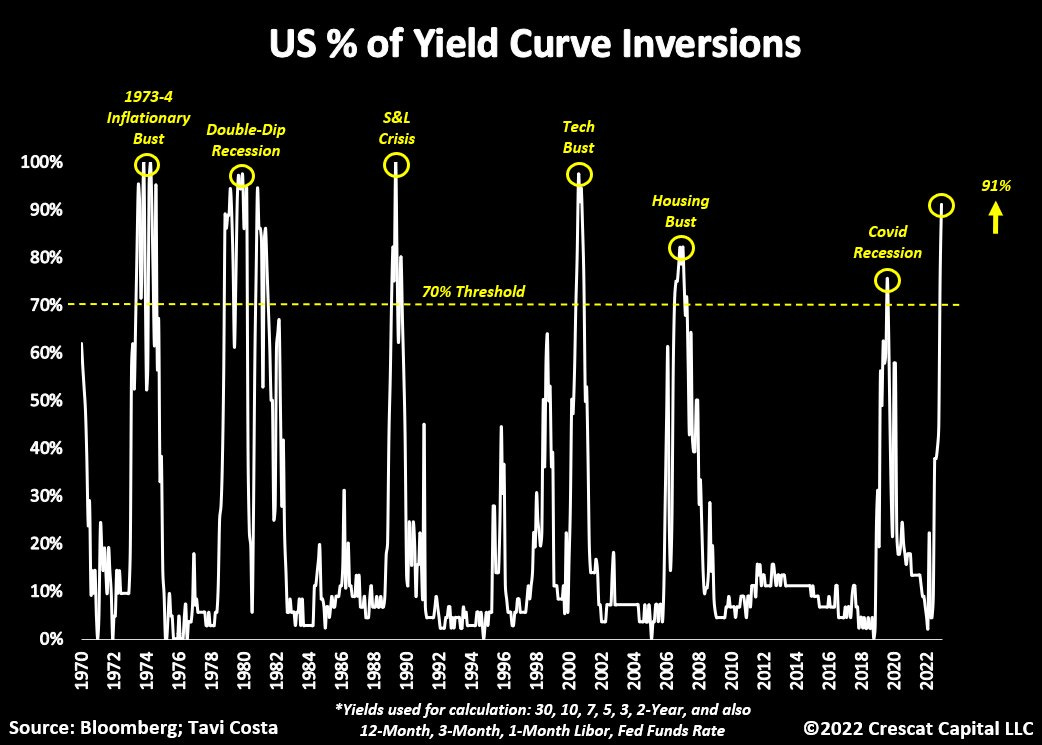

This liquidity tightening have also cause one of the deepest yield curve inversion, where the 10Y-2Y curve in USA is trading close at -0.595%. For those who aren’t familiar over the implication of this please scroll to the next pic.

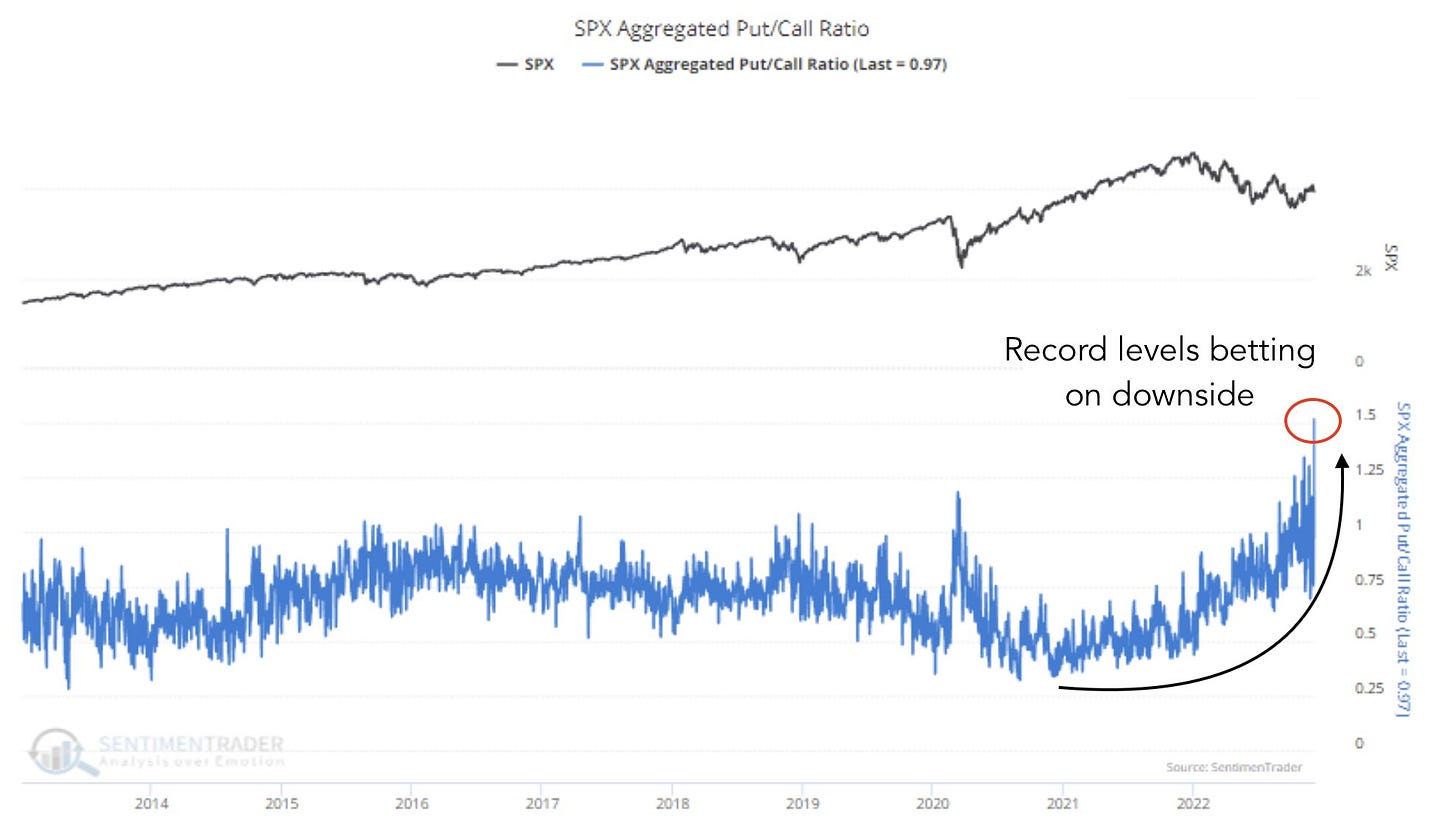

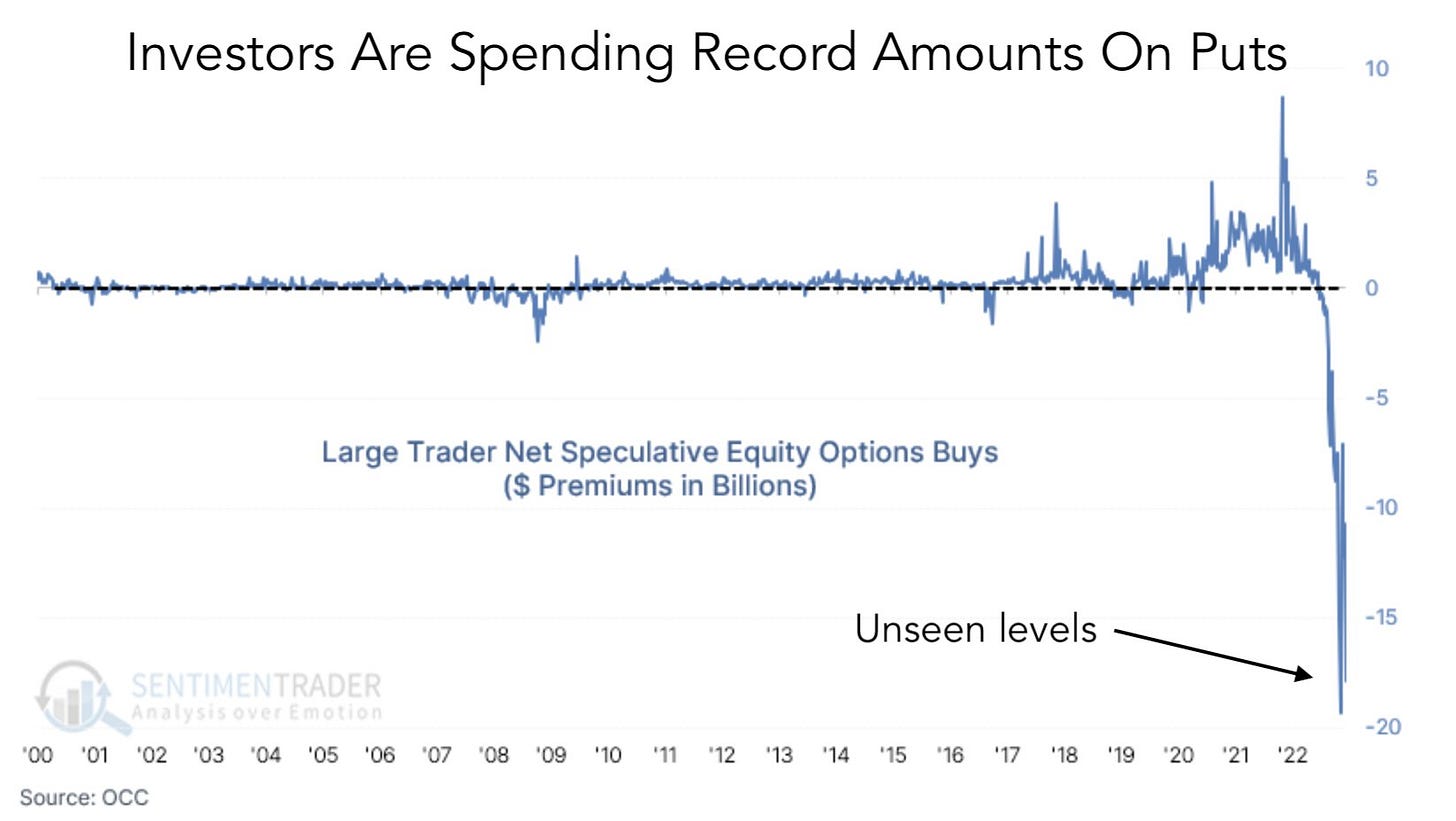

That’s right, the yield curve is hinting that a potential black swan event to occur. Which bring us to the next question, if markets have fully priced in this anticipated event, as sentiment from investor positioning is telling us that most if not all are bearish.

Equally if this time resembles 2000/2008 recession, we should see further downside in risk asset. Truth is I do not know if market have fully price in the downturn, and we have to respect multiple potential scenario and allocate capital accordingly, i.e. always have cash buffer in case you’re wrong. Either deploy aggressive risk cutting measure, or only buy and hold asset you believe that will deliver value over a long period of time. Personally I’m a chart guy that look for fundamentals to stack odds in my favour, hence I would be more comfortable to have confirmation on both fronts before being aggressive.

Given how rate of change of risk asset have almost / if not completely caught up with YoY changes in CPI, I would argue that 2023 will bring in looser financial condition than what we’ve experienced this year. This does not mean that sky is clear and one should go full risk on, but bulk of the downside move have played out.

Personally I am cautiously optimistic in the year ahead, and my bull case is to see a repeat of btc 4 yr halving cycle having positive impact on crypto asset prices. Now some could argue that BTC supply halving for next cycle will have marginal impact on price since the rate of change is drastically lesser, however one could also argue that since BTC was launched post US housing crisis, which coincide with 4 yr liquidity cycles (fed QE intervention), liquidity cycle will/have been playing a bigger factor for price, which is why macro aspect have to be taken seriously even when one is dabbling with smaller crypto projects.

INFLATION have been the key reason on why the FED have decided to hike rates aggressively causing the price of money to increase, leading to weaker demand, this ironically cause problems in financial markets/economy that forces the Fed to act to “SAFU” the system.

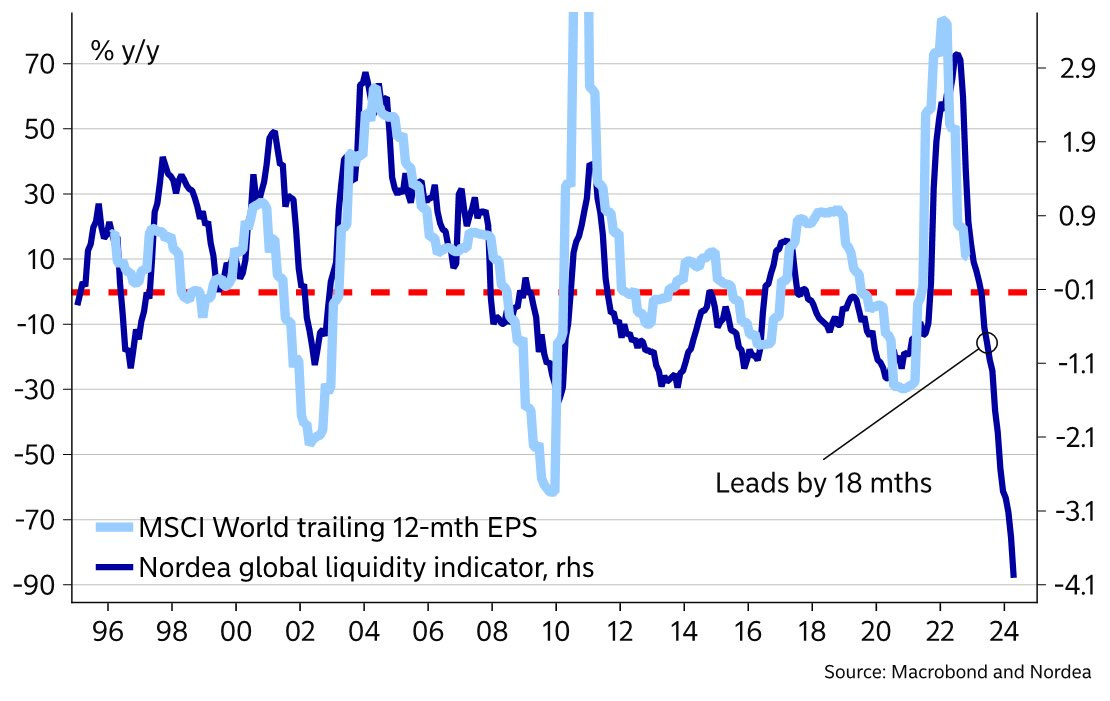

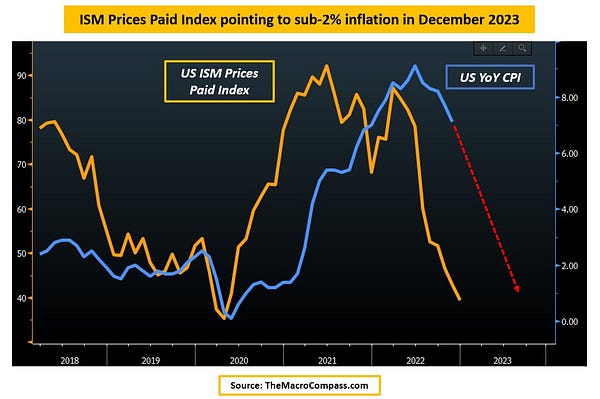

Given that central bankers are always behind the curve, it doesn’t surprise me to see them breaking the system intentionally/unintentionally (LOL), while leading liquidity indicator is signalling sharp disinflation/deflation coming (note we haven’t see such a sharp decline in liquidity indicator in decades! and that is not good when the global financial system is laden with debts through the roof!)

In order for the fed to start easing we need to see labour market (lagging data) deteriorate and at the moment they are still strong, I expect this to change in coming Q1 jobs data release, by then we should have a better idea on how the following quarters should unfold.

Coming back to crypto where are we now and where are we heading???

I would be bearish after digesting all the charts above however when we put btc on a log regression channel, it is currently 2 std deviation oversold.

given how last cycles have look differently in their bear phase, I wouldn’t want to guess how this one would look like but to say it is good to allocate capital when prices are low. Now of course what goes down, can keep going down, hence sizing and time horizon is important.

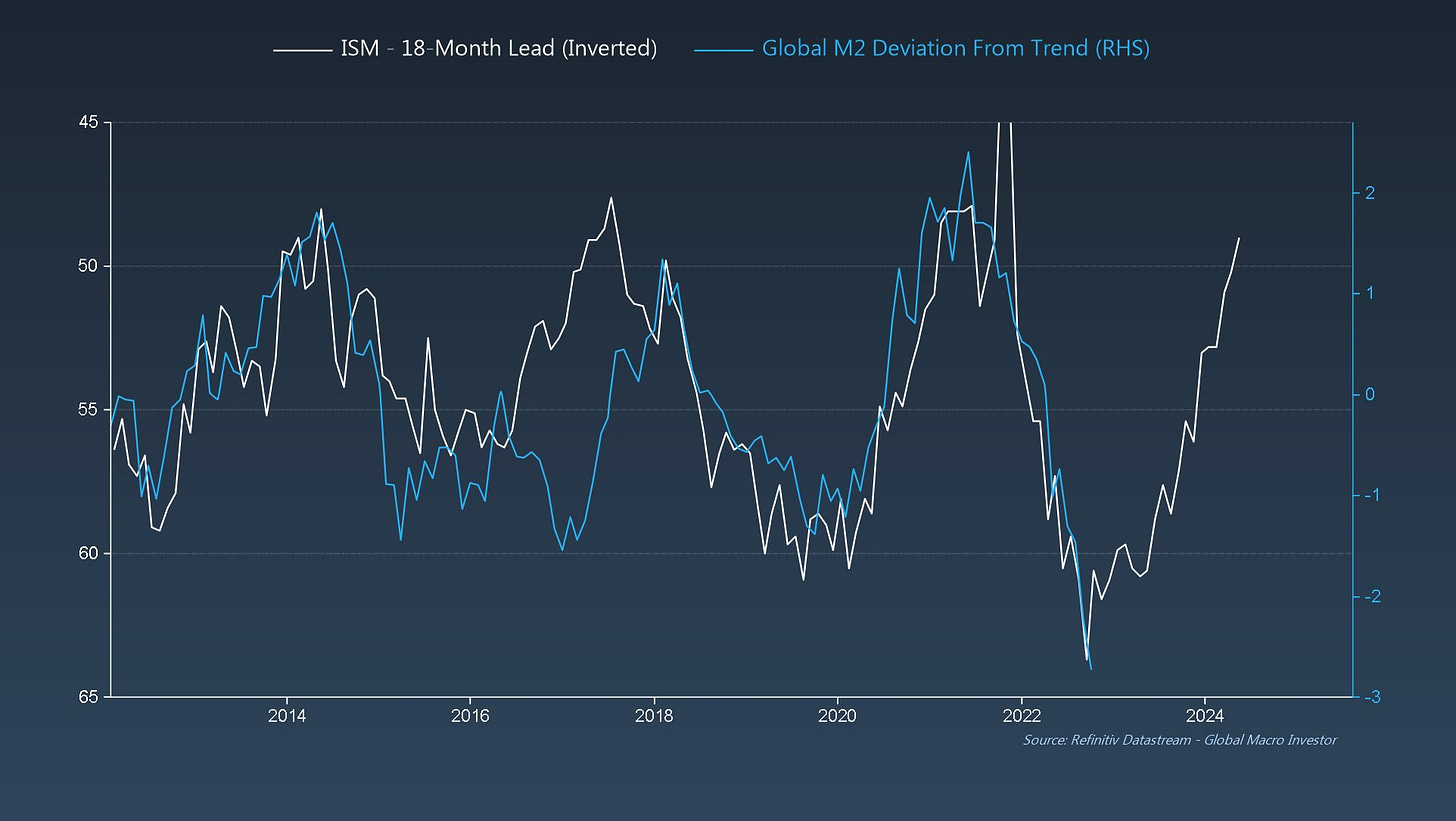

One positive development is that ISM is leading M2 and if you look at the first chart posted in this article, it is looking good for BTC.

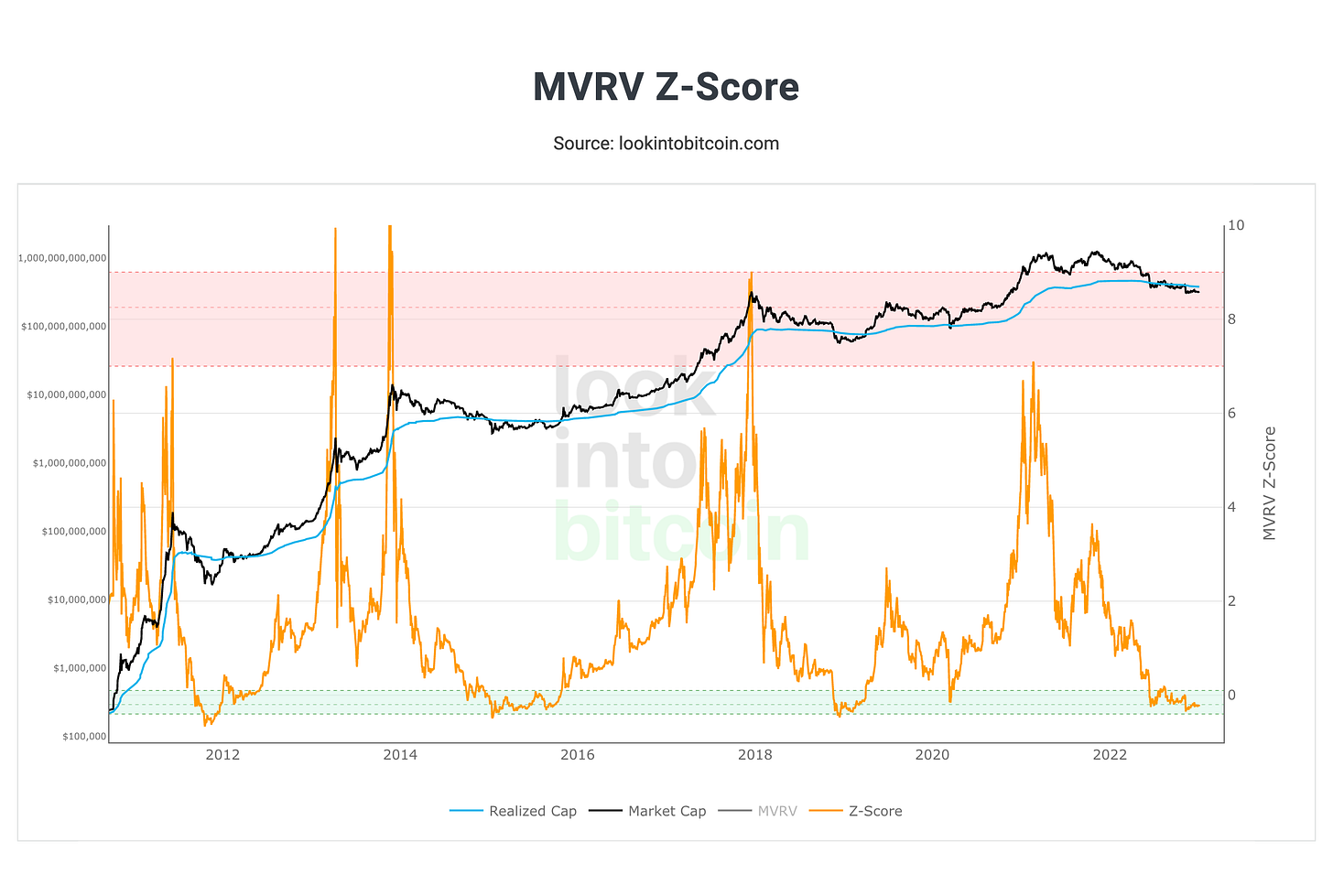

Onchain stats are signalling price at undervalue territory that look similar to 2015 period.

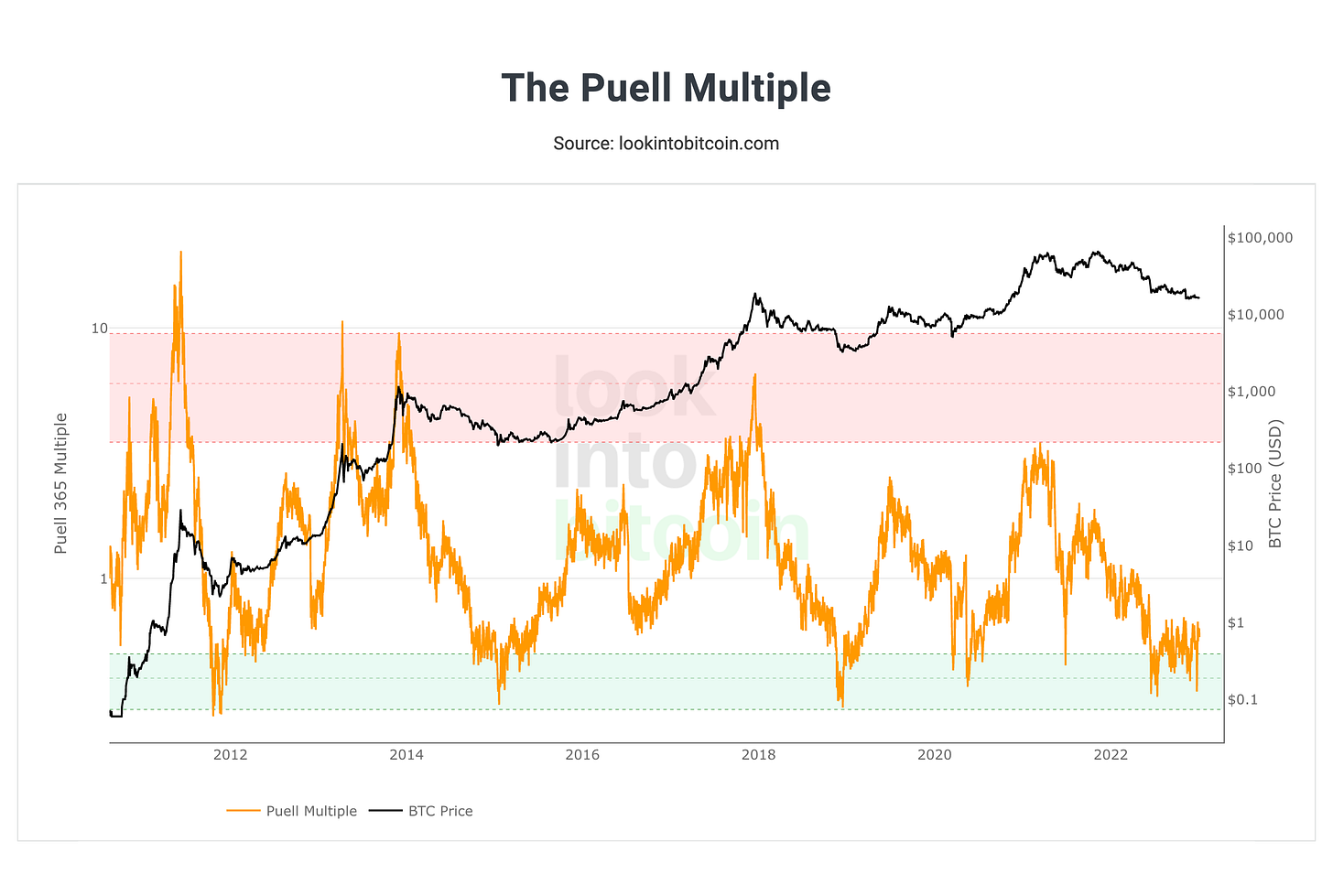

Puell multiple though would look better if it reach 0.3, where past cycle bottom have met. you can find out more of these data from https://www.lookintobitcoin.com/

Now personally I’m more bullish in alts as they offer higher beta in bull markets, however they perform worse when BTC is underperforming. hence, I would size the entry smaller and be more conservative in selection. One bright side we have in bear cycle is TIME, time to research, learn , follow up on interesting small caps project to allow us to be a better informed DEGENS when APE szn comes.

In Summary i think bulk of the downside in crypto prices have played out (that doesn’t mean that price action can’t capitulate further or remains muted). However given the macro condition that I have layout above, if and when a black swan event happen, I’m pretty sure central bankers & fiscal authorities will rush out to ease and support the system via a hybrid of QE and fiscal stimulus. That is when the music starts again!

Till then stay SAFU and keep learning/building/surviving! Wagmi.